ve(3,3)

What is it?

The ve(3,3) model is an innovative tokenomics framework in the decentralized finance (DeFi) space. It combines elements from two different models: the vote escrow (ve) model, used by protocols like Curve and Convex, and the (3,3) model from Olympus DAO.

Key Features of ve(3,3):

Dual Token System: The ve(3,3) model employs a dual token economic design, which helps create a more stable trading environment by separating the cost of using the blockchain from market speculation.

Vote Escrow (ve): In this model, users can lock their tokens to gain voting power. This incentivizes long-term commitment and governance participation, as users who lock their tokens for longer periods receive more voting power.

(3,3) Mechanism: This part of the model is inspired by Olympus DAO and focuses on creating positive-sum outcomes for participants. The idea is that cooperative behavior (e.g., staking and bonding) benefits all participants, leading to a more sustainable ecosystem.

Incentives for Liquidity Providers: The model offers rewards to liquidity providers, encouraging them to contribute to the liquidity pools, which is crucial for the smooth functioning of decentralized exchanges (DEXs)

Token Burns and Governance: The ve(3,3) model also includes mechanisms for token burns and governance incentives, which help maintain the token’s value and ensure active community participation.

How It Works:

Token Locking: Users lock their tokens in the protocol to gain voting power and other benefits. The longer the lock period, the greater the rewards and voting power.

Liquidity Provision: By providing liquidity to the protocol, users earn rewards, which can be further enhanced by locking tokens.

Governance Participation: Token holders can participate in governance decisions, influencing the future direction of the protocol.

Positive-Sum Game: The model encourages behaviors that benefit the entire ecosystem, such as staking and bonding, leading to a more sustainable and cooperative environment.

The ve(3,3) model

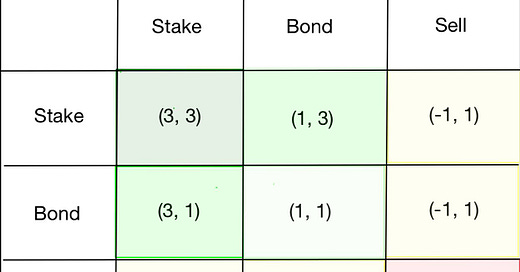

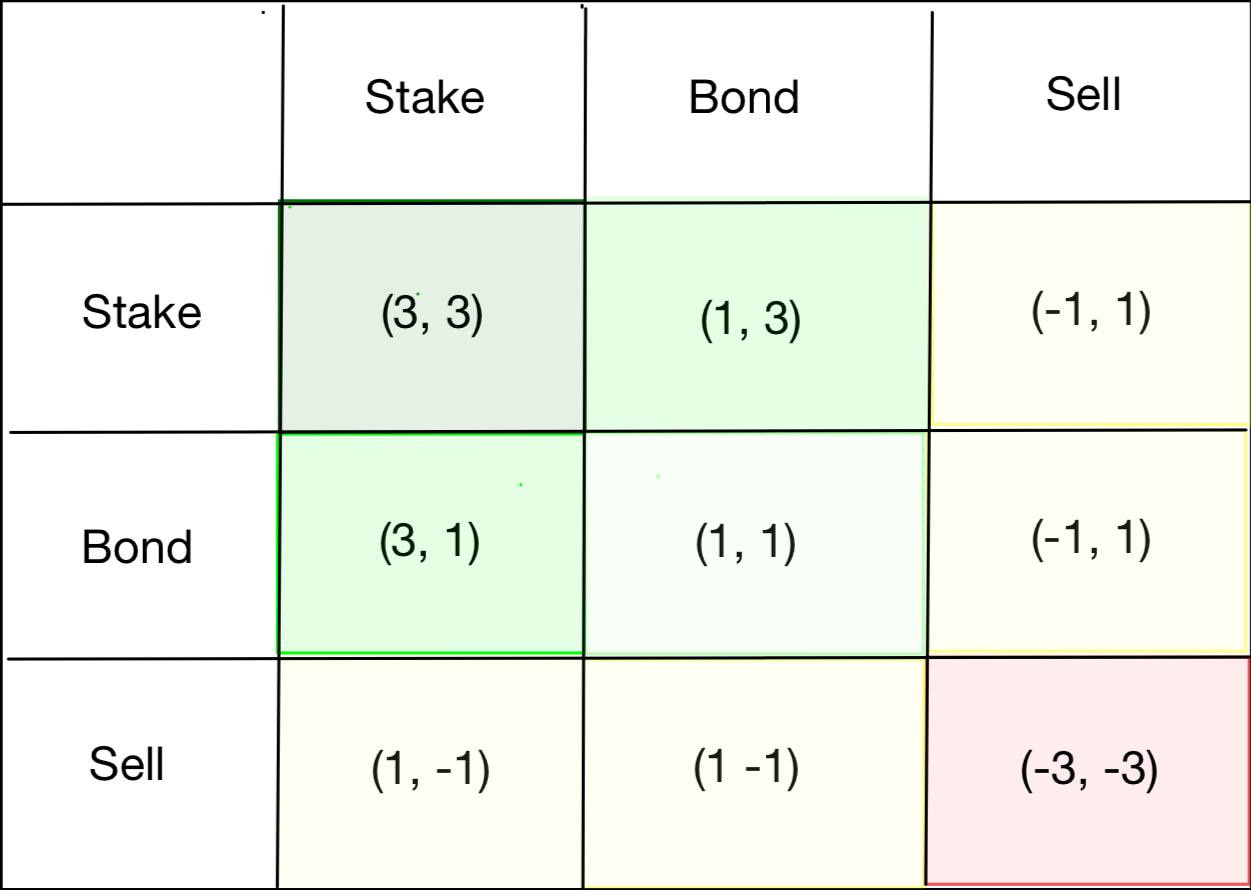

Diagram Overview

The matrix is a 3x3 grid with different strategies labeled as “Stake,” “Bond,” and “Sell” for both players. Each cell contains a pair of numbers representing the payoffs for the two players based on their chosen strategies.

Labels and Payoffs

Rows and Columns: Both are labeled “Stake,” “Bond,” and “Sell.”

Stake: Lock tokens to earn rewards and support the protocol.

Bond: Exchange assets for discounted tokens to help stabilize the protocol.

Sell: Liquidate tokens for immediate profit, potentially harming the token’s value.

Players in the Context of (3, 3)

Row Player: One participant in the Olympus DAO protocol.

Column Player: Another participant in the same protocol.

Cells: Each cell contains a pair of numbers (e.g., (3, 3)), where the first number is the payoff for the row player and the second number is the payoff for the column player.

Example of Cells:

Top-left cell (Stake, Stake):

Payoff: (3, 3)

Both players choose “Stake” and both receive a payoff of 3.

Middle cell in the first row (Stake, Bond):

Payoff: (1, 3)

The row player chooses “Stake” and the column player chooses “Bond.” The row player gets 1, and the column player gets 3.

Bottom-right cell (Sell, Sell):

Payoff: (-3, -3)

Both players choose “Sell” and both receive a negative payoff of -3.

Interpretation

Green Cells: Positive payoffs, indicating beneficial outcomes.

Pink Cells: Negative payoffs, indicating losses.

Mixed Cells: One player benefits more than the other, showing an imbalance in the payoff.

Strategic Insights

Mutual Cooperation: Cells like (3, 3) suggest that mutual cooperation (both choosing “Stake”) leads to the best outcome for both players.

Conflict: Cells like (-3, -3) indicate that mutual conflict (both choosing “Sell”) leads to the worst outcome for both players.

Mixed Strategies: Cells like (1, 3) or (3, 1) show that one player benefits more than the other, which can lead to strategic decisions based on predicting the opponent’s move.

Benefits of ve(3,3) model:

Enhanced Stability: The ve(3,3) model aims to create a more stable trading environment by separating the cost of using the blockchain from market speculation1. This helps reduce volatility, making it more attractive for long-term investors.

Incentive Alignment: By combining vote escrow (ve) and the (3,3) mechanism, the model aligns incentives for all participants. This means that both liquidity providers and token holders are rewarded for their contributions, fostering a cooperative ecosystem.

Governance and Voting Power: Users who lock their tokens gain voting power, which allows them to participate in governance decisions. This ensures that those who are most invested in the protocol have a say in its future direction2.

Early Adopter Rewards: The model rewards early adopters who lock their tokens promptly. These users typically enjoy higher incentive yields and potential price appreciation in the native token.

Token Burns: Token burns are a part of the ve(3,3) model, which helps in reducing the total supply of tokens over time. This can potentially increase the value of the remaining tokens, benefiting long-term holders.

Sustainability: The dual token system and the positive-sum game approach contribute to the sustainability of the ecosystem. By encouraging behaviors that benefit the entire community, the model aims to create a self-sustaining DeFi environment.

Practical Implications:

For Investors: The ve(3,3) model offers a more stable and potentially lucrative investment opportunity due to its focus on long-term incentives and reduced volatility.

For Developers: It provides a robust framework for building sustainable DeFi projects that can attract and retain users through well-aligned incentives.

For Users: Participation in governance and liquidity provision can be more rewarding, both in terms of financial returns and influence over the protocol’s future

Overall, the ve(3,3) model aims to create a more stable and sustainable DeFi ecosystem by aligning incentives for long-term participation and cooperation

Also Read:

ve(3,3): A New Tokenomics Model Transforming DeFi | staderlabs.com

Exploring Ve(3,3): A Comprehensive Guide to Understanding the Tokenomics Model | MEXC Blog

An Overview on veTokens and the ve(3,3) Tokenomics | CryptoEQ

What’s The Deal With The (3, 3) Meme In Crypto? | Token Metrics Research

What Is Olympus DAO (OHM)? Explaining the (3, 3) Meme, Bonding, and Stablecoins | shrimpy.io

[Editor's Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Gordan Toh